From

Wsj.comThe U.S. economy may be showing signs of recovering from the financial crisis, but the jury is still out on the future of the U.S. dollar. While many analysts expect the dollar to strengthen in coming months as the crisis fades and the U.S. economy turns toward growth, a growing chorus of investors is expressing concern about the longer-term outlook for the greenback.

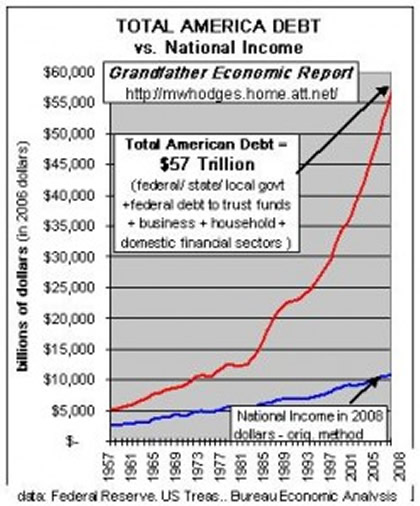

In a new twist to an old refrain among economists, who have long worried about the effects of growing U.S. debt, they say that the huge liabilities the U.S. is taking on to dig its way out of crisis could ultimately undermine faith in the dollar.

"There has been a lot of disappointment with the way the U.S. credit crisis was handled," says Claire Dissaux, managing director of global economics and strategy for Millennium Global Investments Ltd., a London investment firm specializing in currencies. "The dollar's loss of influence is a steady and long-term trend."

On Tuesday, the Obama administration added fuel to concerns about the dollar, saying the U.S. will run a cumulative budget deficit of $9 trillion over the next 10 years, $2 trillion more than it had previously projected.

"That's going to be negative for the dollar," says Adam Boyton, a currency analyst at Deutsche Bank AG in New York. President Barack Obama also reappointed Federal Reserve Chairman Ben Bernanke, whose efforts to rescue the economy have won praise, but have also entailed pumping large amounts of freshly created dollars into the financial system.

Investors and economists have long harbored concerns about the dollar's decline, especially in the beginning of this decade as the federal government and consumers ran up their debtloads to finance everything from foreign wars to flat-screen TVs. Last fall's financial crash suggested that such fears may be overblown: As markets plunged in the wake of the collapse of Lehman Brothers Holdings Inc., investors scrambled to stash their cash in U.S. Treasury bills, perceiving them to be the safest investments. That boosted the value of the U.S. dollar against many of its major counterparts.