President Obama's budget will likely produce $13 trillion in deficit spending over the next 10 years--nearly $4 trillion more than forecast. The White House figures are based on unrealistic estimates of discretionary spending, interest payments, and interest rates. The White House also used budget gimmicks to hide the full cost of certain entitlements and failed to account for the full costs of cap-and-trade energy legislation and health care reform.

Friday, September 25, 2009

President Obama's Agenda Would Bring $13 Trillion in Budget Deficits, Not $9 Trillion

Americans believe Washington squanders half of every tax dollar

If you want to know why Americans are so fearful of a government takeover of the health-care system, take a look at the results of a new Gallup poll on government waste released Sept. 15. One question posed was: "Of every tax dollar that goes to Washington, D.C., how many cents of each dollar would you say is wasted?" Gallup found that the mean response was 50 cents. With Uncle Sam spending just shy of $4 trillion this year, that means the public believes that $2 trillion is wasted.

In a separate poll released on Monday, Gallup found that nearly twice as many Americans believe that there is "too much government regulation of business and industry" as believe there is "too little" (45% to 24%).

Perhaps most significantly, in both of these polls Gallup found that skepticism about government's effectiveness is the highest it's been in decades. "Perceptions of federal waste were significantly lower 30 years ago than today," say the Gallup researchers. Even when Ronald Reagan was elected president in 1980 with the help of the antigovernment revolt of that era, Americans believed only 40 cents of every dollar was wasted, according to Gallup.

Coming next year: Cash deficits in Social Security

Pretty soon all the people who talked about the "money" in the trust fund will learn otherwise. The CBO projects that the first cash deficits since the 1980s will show up next year and 2011. Ed Morrissey has the details at Hot Air.

During the Bush administration, opponents of reforming the system constantly repeated the refrain that when payroll taxes can no longer provide enough for Social Security outlays, the program will simply tap Treasury securities in the trust fund.

But that's when we'll find out those bonds are like IOUs you wrote yourself after tapping your kids' college fund. They can't be redeemed without doing what you would have to do if they didn't exist: Raise taxes, borrow more or cut spending.

The cash shortfall wasn't supposed to happen until 2017, but thanks to the weak economy, the problem is showing up a lot sooner.

Recipients will still receive their payments, but much of that money will come from the general fund, not payroll taxes.

Friday, September 18, 2009

Treasury to Shrink Financing Program

The Treasury Department is expected to begin winding down a temporary program created at the height of the financial crisis to address a new problem -- the government's rapidly expanding debt.According to people familiar with the matter, the step is being taken to help the Treasury avoid hitting the $12.1 trillion debt ceiling that was expected to be reached by mid-October. The decision could also be controversial, since the program was put in place to help blunt any inflationary impact from emergency actions taken by the Federal Reserve.

Since last year, the Treasury has been selling special short-term securities and placing the proceeds in an account at the Fed. The program, known as the Supplementary Financing Program, reached about $560 billion late last year, but has since fallen to about $200 billion, where it has remained throughout 2009.

Government officials estimate that decreasing the size of the Supplemental Financing Program could give the U.S. as much as six weeks of additional time.

China Asks Citizens to Buy Gold and Silver

China currently owns more than a trillion dollars of the government's debt. The Chinese have lent the United States money in the past, because they felt it was in their best interest. Because they have such a large investment in our finances, they have in the past lent to us. As they lose confidence in the US economy, they are less eager to lend money. In February, Luo Ping, who is a director-general for the Chinese Banking Regulatory Commission, stated "we hate you guys" when referring to the US government's spending binge. They are clearly not happy about lending to the US government, because it has failed to clean up its spendthrift ways.

Getting out of Dollars

Although the Chinese government is still buying dollars, they are slowly divesting of their investments, spending more dollars than they are buying. At the same time that China has been slowly reducing their dollar holdings, the country has been

investing in gold by investing in gold mines. The Chinese must believe that it is in their best interest for their citizens to buy gold, or they wouldn't be pushing their citizens to do so.If the Chinese government continues to dump US dollars, they will have less of an incentive to keep the dollar afloat. This could result in inflation, or perhaps even hyperinflation, for the dollar. By encouraging the citizens of the most populous country in the world to purchase precious metals, the supply of gold and silver could become limited, causing an increase in the price.

Senate urged to raise $12T debt cap

From Politico.com

Six major trade associations urged Senate leaders to quickly to raise the $12.1 trillion cap on the national debt, a move that will undoubtedly cause political headaches for Democrats facing serious questions about the cost of health care reform.

Treasury Secretary Timothy Geithner warned Congress at the beginning of August that the current limit on how much the federal government can borrow could be hit as early as mid-October.

How Much Debt Is Too Much?

The latest budget projections show the national debt rising from $5.8 trillion last year to $7.6 trillion this year and $14.3 trillion in 2019. According to the Congressional Budget Office (CBO), the debt will rise from 40.8% of the gross domestic product in 2008 to 53.8% in 2009 and 67.8% in 2019.

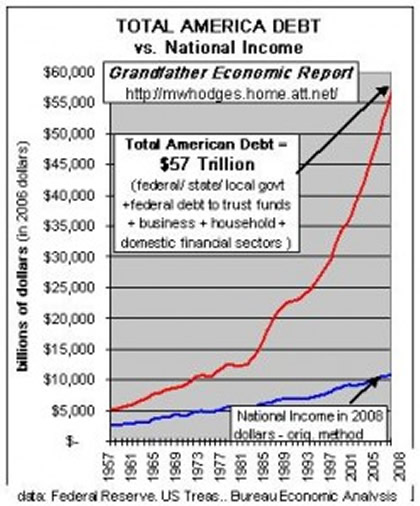

Today the total US debt to GDP is approx 425%.

The question is, can this debt reach 100% of GDP at around $13 trillion. Putting things into context…before the Great Depression in 1929 the US Govt debt was only 15% of GDP! To make matters even worse, the US in 1929 was a creditor nation. Today the US is a debtor nation. Comparing the current situation to the situation prior to the Great Depression total US debt (individual, business,local, state and federal) was approx 170% of GDP.

Today the total US debt to GDP is approx 425%.

Could the US ,the UK as well as the rest of the world be entering a crisis worse than the Great Depression? I state this because of the amount of debt that in all reality can not be paid back. I am not even mentioning all the trillions of derivatives floating around, that are virtually WORTHLESS! Can the situation really get worse because the whole world is in the same boat? The interwining of the global economy is unprecedented in world history.

I believe in real assets. I have never heard of any country has ever solved a credit crisis by printing more money. When countries print money…eventually inflation ( the wealth destroyer) raises it ugly head. We saw first hand in 1998 Debt Deflation in East Asia brought on tremendous inflation. Nothing ever changes.

Thursday, September 10, 2009

Social Security is Broke

The CBO now projects that Social Security’s costs will exceed tax income in 2010 (next year!) and 2011, with cash surpluses returning over the 2012-2015 period and becoming negative again beginning in 2016 and later. In their March 2009 estimates, the CBO projected that the cash surplus would be positive through 2016. Keep in mind that these projections are based on what many economists of all stripes believe are far-too-rosy White House budget numbers. It's a very real possibility that a positive cash surplus may not occur at all.

Deficits don't matter, until they do.

From Times.com

For a time last year, it appeared that this deficit-ignoring bliss might end. Chinese officials said repeatedly that they were uncomfortable holding so many U.S. securities. Interest rates on Treasuries inched up. And another billionaire launched an assault on deficit spending — this time private-equity kingpin Peter Peterson, who took most of the $1.9 billion he made from the 2007 initial public offering of his Blackstone Group and put it into a foundation devoted to raising fiscal awareness.

Then came the Panic of '08. Investors saw Treasuries as a safe haven and poured money into them, driving down interest rates. Officials in Washington spared no expense in battling the crisis. The result is a deficit of unprecedented size but with no perceptible pressure from financial markets to reduce it. No pressure so far, at least. The federal debt, at $7.6 trillion, is now above 50% of GDP and rising. The government faces commitments to Social Security and Medicare that dwarf that figure. Republican congressional leaders have decided they care about deficits again — and seem to be making headway in public opinion. The prevailing winds will shift one of these days. Because deficits don't matter, until they do.

President Barack Obama used only-in-Washington accounting Wednesday when he promised to overhaul the nation's health care system without adding "one dime" to the deficit. By conventional arithmetic, Democratic plans would drive up the deficit by billions of dollars.The president's speech to Congress contained a variety of oversimplifications and omissions in laying out what he wants to do about health insurance.

A look at some of Obama's claims and how they square with the facts or the fuller story:

OBAMA: "I will not sign a plan that adds one dime to our deficits either now or in the future. Period."

THE FACTS: Though there's no final plan yet, the White House and congressional Democrats already have shown they're ready to skirt the no-new-deficits pledge.

House Democrats offered a bill that the Congressional Budget Office said would add $220 billion to the deficit over 10 years. But Democrats and Obama administration officials claimed the bill actually was deficit-neutral. They said they simply didn't have to count $245 billion of it — the cost of adjusting Medicare reimbursement rates so physicians don't face big annual pay cuts.

Their reasoning was that they already had decided to exempt this "doc fix" from congressional rules that require new programs to be paid for. In other words, it doesn't have to be paid for because they decided it doesn't have to be paid for.

Thursday, September 3, 2009

Obama administration adding $3 million per minute to national debt

The Obama administration released in the past 2 weeks revised projections that the 2009 deficit will amount to just shy of $1.6 Trillion dollars and that their long term budget projections will create $9 Trillion dollars of deficits in the next ten years. More than a year ago for another organization, I excoriated the Bush Administration for years of unchecked government spending culminating in the single largest deficit in US history. At the time, that budget deficit of half a Trillion dollars amounted to over $1 million dollars a minute in new national debt; an debt level that simply is not sustainable. With no balance of power in Washington this year, the drunken spending of politicians has tripled the record breaking Bush deficit, creating a phenomenal $3 million of new national debt every single minute (not total government spending, but new government debt). As a result, during the 8 hours of time you will spend at work today, the US government will go more than $1.4 billion into debt.

Just how much debt does $3 million a minute equate to? Consider the fact that the average American earns approximately $40,000 a year. As a result, the Obama administration's $1.6 trillion deficit is equivalent to the total earnings of 37.5 million Americans. What is even scarier, is that the deficit is projected to remain level next year, even without the addition of health care, immigration, education and tax reforms that remain on the President's agenda.

Our government cannot continue to operate in the fashion it currently is. During the Bush presidency we saw the national debt double and now the Obama administration is projecting that it will nearly double the national debt again. Depending on whether you read the Administrations estimates, the Congressional Budget Office projections or other non-partisan projections, the national debt is expected to rise to between $18 trillion and $23 trillion by 2019. Again the numbers seem staggering and unfathomable, but I can shed some light on just how much money that is. Considering our population of 300 million citizens, a $19 trillion debt in ten years would amount to $63,333 of national debt for every man, woman and child in the US. If our population was to grow to 450 million people by 2019, then the national debt would amount to $47,499 for every citizen. In other words, your personal share of the national debt will be the equivalent of some Americans current mortgages. Even more stunning is the realization that if wages were to grow at a 3% rate, the average American's share of the national debt would be more that their annual wages.

Campaign to Raise Awareness About Soaring National Debt

A nonprofit advocacy group has launched a multimillion-dollar campaign to raise awareness about America's soaring federal debt.

The multimedia campaign is trying to hammer its message on all fronts. It includes a Web site -- Defeatthedebt.com, which features a rolling odometer showing the red ink at over $11 trillion -- and a startling new TV ad. The ad shows school children pledging allegiance to the national debt.

"And to the Chinese government that lends us money, and to the interest, for which we pay, compoundable, with higher taxes and lower pay until the day we die," the school children in the ad say.

Organizers say it's a critical educational campaign to inform the public of the real-world consequences of owing so much on the national credit card.

"We're also trying to get people to understand who we owe all this debt to, and the leverage that foreign governments and foreign banks have over this country when they start to accumulate that much debt," said Rick Berman, executive director of the Employment Policies Institute, the conservative group behind the campaign.

Taken together, this year's $787 billion economic stimulus package, the ongoing rescue of American automakers and new proposals to spend $1 trillion reforming health care may make it tempting, to some, to blame President Obama for the sea of red ink. The projected federal deficit this year is $1.6 trillion.

Wednesday, September 2, 2009

President Barack Obama’s borrow and spend policies

From Heritage.org

- While President Obama claims to have inherited the 2009 budget deficit, it is important to note that the estimated 2009 budget deficit has increased by $400 billion since his inauguration, and the whole point of the “stimulus” was to increase deficit spending to nearly $2 trillion based on the unproven notion that would it alleviate the recession.

- The 22 percent spending increase projected for 2009 represents the largest government expansion since the 1952 height of the Korean War (adjusted for inflation). Federal spending is up 57 percent since 2001.

- In 2009, Washington will spend $30,958 per household–the highest level in American history–and under President Obama’s budget, the figure will rise above $33,000 by 2019.

- The White House brags that it will cut the deficit in half by 2013. The President does not mention that the deficit has nearly quadrupled this year. Merely cutting it in half from that bloated level would still leave budget deficits twice as high as under President Bush.

- The public national debt–$5.8 trillion as of 2008–is projected to double by 2012 and nearly triple by 2019. Thus, America would accumulate more government debt under President Obama than under every President in American history from George Washington to George W. Bush combined.

How was this seemingly impossible feat accomplished?

You read that right: A government-run gambling monopoly has gone broke, after losing money for years.

How was this seemingly impossible feat accomplished? There are clues in stories at Reuters and Bloomberg

From here, it seems that OTB probably has hired too many people, paid the people they hired too much, provided overly generous benefits, couldn't eliminate unprofitably outlets, and perhaps fell behind on technology and investment in the future. All in all, as a government operation, it has turned what should be a fairly simple-to-run money pot and into a money pit.